|

|

Authored by Dan Mitchell June 20, 2011

One of the tax increases buried in Obamacare was an onerous and intrusive “1099″ scheme that would have required businesses to collect tax identification numbers for just about any vendor and then send paperwork to the IRS whenever they did more than $600 of business.

- Send one of your sales people to New York for a couple of nights? They would have to get the tax ID for the hotel and submit a form to the IRS.o Buy a printer for the office? The printer company would need to provide a tax ID and the purchaser would have to submit a form to the IRS.

- Have a retirement dinner for somebody in the accounting department? Get the restaurant’s tax ID and submit another form to the IRS.

This system was seen as a nightmare, even leading to rather amusing cartoons mocking the law and showing how it would expand an already abusive IRS. And in a rare fit of common sense, the 1099 requirement was repealed earlier this year.

That’s the good news. The bad news is that an international version of Obamacare’s 1099 scheme also was enacted early last year. But since the burden is largely falling on foreigners, there’s no groundswell among voters to repeal the law – even though it will impose far more damage on the American economy.

Known as the FATCA (the acronym for the Foreign Account Tax Compliance Act), this law was included as a revenue-raising provision to pay for one of Obama’s failed stimulus bills.

But while the bill didn’t create jobs, it has created a giant nightmare for all sorts of people and firms – including foreign financial institutions that may now decide that it’s no longer worth the trouble to invest in America.

Consider these excerpts from a shocking story in the Financial Times.

…one of Asia’s largest financial groups is quietly mulling a potentially explosive question: could it organise some of its subsidiaries so that they could stop handling all US Treasury bonds?

Their motive has nothing to do with the outlook for the dollar.

…Instead, what is worrying this particular Asian financial group is tax. In January 2013, the US will implement a new law called the Foreign Account Tax Compliance Act.

…[T]he new rules leave some financial officials fuming in places such as Australia, Canada, Germany, Hong Kong and Singapore. …[I]implementing these measures is likely to be costly; in jurisdictions such as Singapore or Hong Kong, the IRS rules appear to contravene local privacy laws. …Terry Campbell, head of Canada’s banking association, points out, the rules are essentially akin to “conscripting financial institutions around the world to be arms of US tax authorities”.

…[T]he IRS is threatening to impose a withholding tax of up to 30 per cent on sales of US assets by groups that it deems to be “non-compliant” – and the assets could include US shares or US Treasury bonds.

Hence the fact that some non-US asset managers and banking groups are debating whether they could simply ignore Fatca by creating subsidiaries that never touch US assets at all.

“This is complete madness for the US – America needs global investors to buy its bonds,” fumes one bank manager. “But not holding US assets might turn out to be the easiest thing for us to do.”

…“Right now my board is probably as concerned about political risk in America as Indonesia, from a business perspective – perhaps more so,” says the head of one large global bank. It is a complaint that American politicians ignore at their peril.

Many people, when hearing about foreign banks resisting demands by the IRS, might automatically assume the issue involves jurisdictions with strong human rights laws with regards to financial privacy, such as Switzerland or the Cayman Islands.

There are plenty of those stories, to be sure, but American tax law has become so bad that the IRS is causing headaches and anger even in nations with high taxes and weak protection of client data.

Here’s an excerpt from an article from the Financial Post in Canada.

Toronto-Dominion Bank is putting up a fight against a new U.S. regulation that would compel foreign banks to sort through billions of dollars of deposits to find U.S. citizens who might be hiding money. According to Bloomberg News, TD has complained that the proposed IRS rule is unreasonable because it would require the bank to make US$100-million investment in new software and staff. Other lenders resisting the effort include Allianz SE of Germany, Aegon NV of the Netherlands and Commonwealth Bank of Australia, Bloomberg said. Now the Canadian Bankers association has joined the fray. In an emailed statement the CBA called the requirement “highly complex” and “very difficult and costly for Canadian banks to comply with.” …According to the New York-based Institute of International Bankers, major global banks would end up spending US$250 million or more to comply with the regulation in terms of new technology employee training.

The vast majority of Americans are very fortunate that they don’t have any personal interactions with the IRS’s onerous international tax rules. But that doesn’t mean they shouldn’t care. The tax treatment of cross-border economic activity can have enormous implications for America’s prosperity, as I’ve already explained in my discussions of a reckless IRS regulation that could drive more than $100 billion of capital out of American banks.

But that’s just the tip of the iceberg. FATCA is far more onerous and extensive, so the damage will be much greater. Not surprisingly, the law utterly fails to satisfy any sort of cost-benefit analysis.

From the perspective of politicians, the “benefit” is more tax revenue. So how does FATCA score on this basis? During the 2008 campaign, Obama claimed this policy would generate $100 billion of additional revenue every year. When it came time to score the legislation, however, the Joint Committee on Taxation predicted that the law will generate only $870 million per year. That’s a big drop-off, even by the shoddy standards of Washington.

Yet for this tiny amount of revenue, the law imposes a giant regulatory burden on all individuals, companies, and institutions that meet two criteria: 1) They have some form of cross-border economic activity, and 2) They have a business or citizenship relationship with the United States.

Americans living overseas are one of the groups that will be severely penalized. Simply stated, foreign financial institutions are treating U.S. citizens like lepers because they don’t want to deal with the IRS and be deputy enforcers of terrible American law. Here are comments from some of Americans living in other nations (all of whom wish to remain anonymous because they fear being targeted by a thuggish IRS).

- From an American with a spouse working in Germany – “…when he went to create an account, he discovered that the bond fund could not be sold to US citizens.”

- From a non-profit group operating in Europe – “…we received notification from [bank redacted] that they were terminating our account.”

- From an American working in Switzerland – “I’m in the process of having my…accounts with [bank redacted] forced closed, except for the mortgage. I’ve been unable to open an account with any other Swiss bank.”

- From an American living in Belgium – “…my portfolio of investments held at their bank was blocked. …He advised me that as of that date, I could no longer trade, but could only hold, sell or transfer my portfolio. I was banned from trading in either US stocks or all others.”

- From a retired teacher in Germany – “I was denied the policy because I am an American citizen. My agent very clearly said that he could sell the policy that I wanted to any other nationality, except me-because I was American!”

- From an American working in Saudi Arabia – “As a resident of Saudi Arabia, I have twice been rejected as a customer, purely on the basis of my US citizenship. In both instances, I was told that increased administrative and compliance burdens imposed by US authorities have led the banks in question to refuse to open securities accounts for American citizens.”

- From an American in Japan – “All of these banks and institutions are cutting me off from participation in any but the most simple of basic bank account. Why? Because they do not want to take the time and instill the systems and carry the cost of reporting the income of each of their US citizen clients to the US government.”

- From an American married to a European – “I have been unable to gain legal advice in Switzerland regarding US Wills and Guardianships because [bank redacted] lawyers are ‘not permitted to speak to Americans about legal, tax or banking matters in specific terms.’”

- From an American married to a European – “The company who has been holding my modest UK share portfolio wrote to me in September 2010 saying they were closing my account. They were removing all US persons from their client base due to the increased reporting and audit costs placed on them by the Fatca legislation.”

- From an American in Europe with a foreign spouse – “They sent me a letter saying: Our records show that you are an American citizen. Because of various strict new American rules regarding securities accounts held by American shareholders, we are closing such accounts including yours.”

- From an American assigned overseas by his company – “I was extremely surprised and outraged by the fact that not one bank (including foreign branches of US banks!) would allow me to open a simple savings account to pay my rent and bills. All of the banks cited my US citizenship and the difficulties they experience with the US government.”

- From an American in Spain – “I have been forced to close a U.S. bank account due to being an overseas citizen and cannot open new bank or brokerage accounts in the U.S. I am also being denied the opening of new brokerage accounts in Spain.”

Last but not least, another set of victims are foreigners who legally reside in the United States. That makes them tax residents according to American tax law, which means that they also are lepers from the perspective of foreign financial institutions.

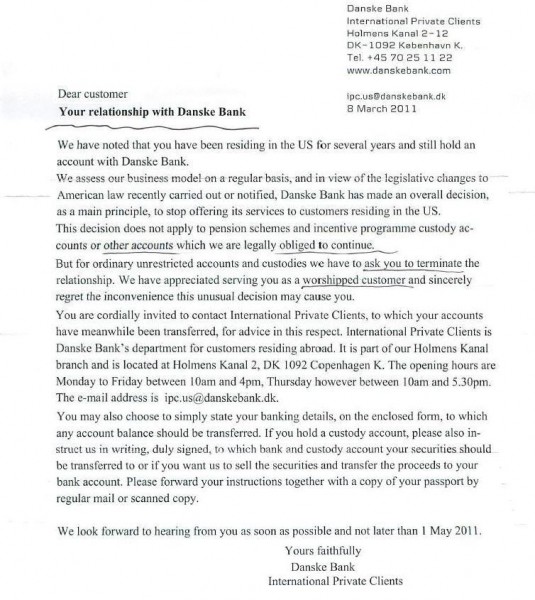

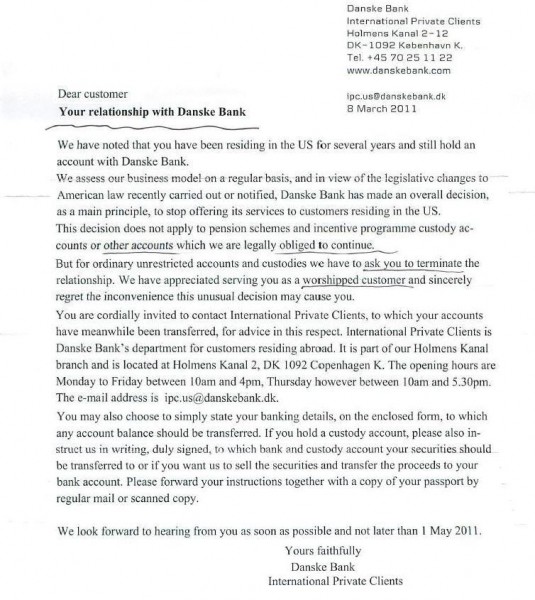

Let’s close this lengthy post by including this letter from a Danish bank to a Danish citizen living in the United States. Once again, identifying information is redacted because the person did not want to suffer IRS persecution (it should disturb all of us, by the way, that there is such universal fear of IRS thuggery).

By Jason Sharman

Griffith University, Australia

Issues of poverty and economic under-development have, appropriately, got a great deal of attention from policy-makers and non-governmental organisations (NGOs) over the last few decades. But the relationship between International Financial Centres (IFCs) and economic growth and poverty alleviation in developing countries is largely unexplored. What little scrutiny this relationship has received has tended to portray IFCs as exerting a baleful influence on developing countries. In contrast, it is argued here that at least in the case of China, IFCs may actually assist economic development and poverty reduction. There is evidence that IFCs can make a positive contribute by helping foreign and domestic firms in developing countries access the kind of efficient institutions necessary to drive growth, but which are often unavailable locally.

https://sites.morimor.com/wp-content/uploads/sites/20/2011/06/Sharman_China_IFCs.pdf

June 2, 2011

Mr. Jeffrey Owens

Director

Centre for Tax Policy and Administration

OECD

Dear Mr. Owens:

I would like to reiterate that the real international standard is not what the OECD preaches “transparency and effective exchange of information”. Quite the contrary, it is what the US practices, “Fiscal Competition and Respect for Individual Privacy”. Continue reading (English) Letter from Dr. Eduardo Morgan Jr. to the Director of the Centre for Tax Policy and Administration of the OECD, Jeffrey Owens

By Eduardo Morgan Jr.

For reasons that are easy to understand since they are the product of misleading publicity, in our country there is the erroneous perception that the OECD (Organization for Economic Co-operation and Development) is the international organization responsible for setting the international fiscal rules that include transparency and the effective exchange of information between states. Nothing could be farther from the truth. The OECD, a club, an association of rich countries, a think tank, as it is referred to by Paul Krugman and The Economist magazine, is financed by its 32 members, of which the U.S.A. contributes with 25% of the organization’s budget and this gives it the right to set the organization’s policies. Its 2500 employees are dedicated to producing economic studies for the benefit of its members, and, based on these studies, they develop models that in turn foster the exchange between the economies of its members. These models include those that refer to the Agreements to avoid Double Taxation. Among its policies there are also those intended to avoid that third-party countries compete with its members in financial activities. This I affirm because it is so stated in a document which the OECD made public in the year 2000, (it was a secret) in which they stated (in an unconscious manner, perhaps inadvertently) the following: GLOBALIZATION AND THE LIBERATION OF THE FINANCIAL MARKETS

| 36. |

One of the elements which has propelled globalization during the past decade has been the liberation of the financial markets, a trend which has been fostered by the OECD. This liberation was in part a response to the threat to the financial markets which the foreign Financial Centers represented. During the decades of the 1960’s and 1970’s said financial centers were capable of attracting foreign financial institutions offering a banking system and a minimally regulated tax system at a time during which the technological advances made them easily accessible. As capital flowed towards these foreign financial centers, threatening to undermine the traditional financial markets, a number of regulatory reforms were undertaken to level the playing field between the local banks on the one hand and the foreign banks on the other. (1) Exchange controls were eliminated. Some countries established markets to compete directly with the foreign financial centers. In addition, efforts where made to harmonize the regulation of financial markets on a global basis. |

This is the reason for their war against competing countries, which they qualify as fiscal heavens, which also explains the creation of the much-publicized black, grey, and white lists. The process began with a call for universal collaboration to avoid harmful fiscal competition and they persuaded the non-member countries to commit to obeying the rules to avoid it, to the detriment of the legitimate revenues of other States. The OECD visited Panama, at the time a visit of subtle persuasion, and as a consequence our government agreed to be a part of this commendable initiative. Thus the letter dated April 15, 2002, which, very intelligently, was conditioned to what in English is called a Level Playing Field, that is, the same conditions for everyone. This letter from Panama has been portrayed by the OECD as a “commitment”, and many of our public sector officers, in the past government as well as in the current one, have believed that, effectively, Panama has a “formal” commitment with the OECD, to reform its laws as the latter demands; and in the event that we should fail to do so, we would be incurring in international transgressions subject to sanctions imposed by the remaining countries of the world (black, grey, and white lists). For those of us who have studied international law, and to those who without being lawyers have the degree of culture to know how States conduct their affairs, this is no more than laughable. In respect of this subject, the Panamanian State has not entered into “any international commitment” with any other State, nor with any of the true international organizations of a multilateral nature of which we are a part by virtue of the relevant legal instruments. Should the OECD and the Panamanians which support their statements be right, an Agreement would have had to be negotiated. This “agreement”, in keeping with the usual proceedings, after having been signed by the Foreign Affairs Minister or by whoever represented Panama at the time, must be presented for approval to the National Assembly, become Law of the Republic, and promulgated in the Gaceta Oficial.

The United States of America has utilized the mechanisms and instruments of the OECD, to pressure governments with the argument of the black, grey, and white lists, and to convince Panama so that we finish ceding to them our fiscal sovereignty. This is nothing new and they have been trying to do this for over 25 years. On this occasion we trust that the current government will follow in the footsteps of ex president Guillermo Endara, who with dignity and patriotism rejected the unjust objectives of the United States. We hope all of the government officers and advisors entrusted with this subject are conscious of what the entire universe knows: that the fiscal heaven by antonomasia – and furthermore not transparent since it provides fiscal information to no one, except Canada – is the United States. And that in ceding our fiscal sovereignty, the negative consequences to our financial center will benefit Miami’s financial center in equal proportions.

By Eduardo Morgan Jr.

On September 29, Singapore held the Global Forum on Transparency and Exchange of Information. Yet another hypocrisy from the OECD whose purpose is no other than to eliminate the competition in financial business and legal entities that countries such as Panama represent for the members of its Cartel. In this Forum, we will be subjected to trial in the Court they have given the flashy name of “Par Review”.

This Global Forum is the continuation of the one held in Mexico last year at about this same time and that motivated me to write to Jeffrey Owens, Director of the Tax Policy Center. I transcribe certain parts of that letter, which he of course did not bother to reply, so that Panamanians get to know the OECD and not let themselves be deceived by their false pretension of being an “international organization that establishes mandatory economic and tax principles for all countries”.

“The OECD is not a true international organization as are, among others, the International Monetary Fund (IMF), the World Trade Organization (WTO) and the International Maritime Organization (IMO). The OECD is no more than a club or cartel of 30 rich countries, whose objective – according to its by-laws – is “to help its member countries to achieve sustainable economic growth and employment and to raise the standard of living in member countries.” (The Economist magazine and Paul Krugman, Nobel of Economy and a columnist of the NY Times, call it the “rich countries think-tank”)

“One of the purposes of the OECD is to avoid the competition other financial centers, may pose for the OECD members, its partners, aided by technological advance. Thus, in the document entitled Improving access to bank information, the OECD states that the liberalization of the financial markets was promoted by them as “a response to the threat to financial markets posed by offshore financial centers. Such financial centers, in the 1960’s and 1970’s, attracted foreign financial institutions by offering a minimally regulated banking system and minimal taxation, at a time when technological advances made them more readily accessible”.

“The members of the OECD are largely responsible for the world crisis by neglecting to realize that the relaxation of their regulations would lead to harmful speculation with financial instruments. Therefore, they have now tried to cover up their responsibility with an insidious campaign, filled with fallacies against the so-called Tax Havens, which they have tried to blame for the disaster”.

“In the year 2000, the OECD members spoke of a Level Playing Field, a goal they did not achieve because of its absurdity; today, they have re-labeled it as “Transparency and Exchange of Information.” I transcribe the words of the Secretary General of the OECD, Mr. Angel Gurría: “What has happened is nothing less than a revolution. For decades it has been possible for taxpayers to hide income and assets from the taxman by abusing bank secrecy and other impediments to information exchange. What these developments show is that this will no longer be possible.”

“OECD members themselves have shown us that the whole purpose of this campaign is to prevent competition from other financial centers. Let’s see: The United States, the principal member and largest contributor (25%) to the OECD budget, is undoubtedly the largest Tax Haven in the world. This country, which has the wealthiest economy, is the safest place for investment. IT DOES NOT TAX FOREIGN PASSIVE INVESTMENTS. But that is not all: IT DOES NOT PROVIDE INFORMATION TO THIRD COUNTRIES ABOUT THESE INVESTMENTS. And for greater guarantee of anonymity to its foreign investors, it enters into an agreement with foreign financial intermediaries, which is known as QUALIFIED FINANCIAL INTERMEDIARY, guaranteeing that NOT EVEN THE IRS WILL KNOW THEIR CLIENTS. This is clear evidence that the interest of the members of the OECD is to get rid of the competition, not any issues related to taxes.”

“The foregoing confirms that the article The G20 and Tax Haven Hypocrisy published by The Economist magazine in its March 26, 2009 issue was right on track. The Global Forum of Transparency and Exchange of Information is the summit of hypocrisy and another step in the conspiracy to eliminate financial competition”.

“The OECD cannot go on with this agenda. On the contrary, it should follow the example of the USA and promote healthy competition, such as this great country has done. … This includes confidentiality vis-à-vis abusive governments, both for their tax rates and for their confiscatory policies.”

“Lastly, allow me to remind you that on July 9, 2008, the IMF, a true international organization and part of the UN system, integrated the OFFSHORE FINANCIAL CENTER ASSESSMENT PROGRAM with the FINANCIAL SECTOR ASSESSMENT PROGRAM (Public Information Notice (PIN) No. 08/82, July 9, 2008).”

“Since then, the IMF eliminated any discrimination between “Offshore” and “Onshore,” explaining its reasons as follows: “Typically, the assessments reviewed a jurisdiction’s compliance with supervisory standards in banking, and with the anti-money laundering and combating the financing of terrorism (AML/CFT), and where applicable also assessed compliance with supervisory and regulatory standards in the insurance and securities sectors. Adherence to all four international standards among OFCs was broadly comparable or better, on average, than other countries, reflecting the higher than average incomes of OFC jurisdictions”.

All these concepts are still valid and what is positive is that the USA seems to have put Mr. Gurría in his place. He is no longer parading around as a head of state and seems to have relented. The international press has made it public that the USA is a Tax Haven, not transparent, as well as its companies, which they promote globally (Forbes, The Economist, National Geographic).

The OECD will take yet another turn to avoid affecting its main partner. But it will continue with its Cartel policy. Our best defense is that we are a serious country, with institutions that are an example to other nations, namely, among others, our Financial Center, our Ship Registry and our Corporate System. Our government instead of bowing to the OECD should ignore it and promote the awareness of our reality.

Authored by Andrew Quinlan May 25, 2011

CF&P recently released a paper calling on low-tax jurisdictions to resist the OECD. The high-tax European welfare states which control the OECD continue to move the goal posts and devise ever more hoops through which low-tax jurisdictions are expected to jump. As such, it becomes increasingly important for these nations to draw a line in the sand while they still have some fiscal sovereignty left to defend.

Dr. Eduardo Morgan Jr., former Ambassador of the Republic of Panama to the U.S., has recently done just that as he pushes for Panama to confront the OECD directly. In a March letter, Dr. Morgan slams the OECD’s Director of the Centre for Tax Policy and Administration, Jeffrey Owens, for his hypocrisy in ignoring the fact that the U.S. employs many of the policies which the OECD has deemed unacceptable when practiced by smaller jurisdictions. Continue reading (English) A Line in the Sand Against the OECD from The Center for Freedom and Prosperity

With this Blog I would like to make available to all those interested, family, friends, colleagues, and both adversaries and sympathizers of my thesis, the product of many years of research, interviews, articles, references and collaborations that focus upon Panama as an international center for business and financial services. Here I portray Panama as a young democracy with a dynamic economy, which is competing with the world’s major financial and business centers for the same resources. I feel the need to refute some of the myths and fallacies that weigh upon my country, sustaining my criteria with facts and references. I expose the United States of America´s (USA) double standards and its unfair competition. I strongly criticize the role of the OECD as a protector of the financial interests of its members, thus lacking the status of a truly international organization. But more than anything else, the driving force behind this effort has been my pride as a Panamanian which has led me to devote the better part of my life supporting the development of this great young nation.

My quest began in 1996 as Ambassador to Washington, DC, facing the attacks from the American Government and political sectors upon the mainstream of our economy. This compelled me to study the merits and failures of our system, and also to delve into the policies of the USA. In my book “Memoirs of an Embassy” I narrate how with the decisive help of the Colon Free Zone Users’ Association, the Banking Association of Panama, the National Bar Association, and others, we embarked in a crusade to educate American officials about our economic strengths, Free Zone, international financial system and services. As a result of these efforts, high level representatives from FinCEN (Financial Crime Enforcement Network), Department of Justice, DEA, FBI, and others, ended up praising our country’s active cooperation and commitment in the control of drug trafficking and money laundering activities.

Panama’s economy is thriving. It has a well-regulated financial system that is validated by the International Monetary Fund (IMF), which unlike the OECD is a true international organization. Panama complies with the standards of the WTO and all other international organizations. Furthermore, Panama’s investment risk ratings is supported by Fitch, Moody’s, and Standard & Poor’s. My blog will provide access to these and other references, studies, and links which illustrate the advantages and legitimacy of our international financial and services system. You will find information regarding Panama´s legislation, tax regime and corporations. I also expose the OECD’s double standard and sustain that none of its member countries has a better information system regarding corporations. In particular, I demonstrate the true reason why the USA and several of its States, including Delaware, oppose improvements regarding LLC information; it would affect one of their main sources of revenue.

Furthermore, I discredit the myth of the bearer shares, pointing out that, more than 50% of the 31 OECD member countries, have bearer shares incorporated in their laws. The USA is not one of these, because they do not need them; they have their LLCs (Limited Liability Companies) which in effect render their owners invisible. The best analysis of the difficulties in identifying beneficiary owners in the USA jurisdiction are published in the studies made by the US Congress itself, in the Government Accountability Office (GAO) report, and in the hearings of Senator Carl Levin by the Department of Justice, of Customs, and the FinCEN.

The reality is that in Panama, only attorneys may act as Resident Agents and they are obligated not only to know their customers, but also to register each corporation in the Public Registry recording the names and addresses of the Agent, Directors, and dignitaries. This Registry is online and open to any interested parties. The US Senate hearings, clearly address that the problem of identifying the holders will not be solved by eliminating the bearer shares. This can be established either by the Resident Agent, as in Panama, or in the State registries as proposed by Senator Levin.

In Panama regulatory, supervisory and investigative entities such as the Office of the National Attorney General, the Ministry of Government and Justice, and the Banking Superintendency, have authority to identify any misuse of legal vehicles. Notable examples are cases such as David Murcia, Vladimiro Montesinos, or the former presidents of Costa Rica, Chile, and Nicaragua. All them were identified as ultimate beneficiaries, precisely because they used Panamanian corporations and were subjected to a legitimate international judiciary proceeding.

In ironic contrast, one of the principal members of the OECD, the USA, in an effort to attract foreign capital, provides clear tax advantages to “foreign” investors requiering minimal documentation to identify LLC customers, thus failing to comply with the group’s standards. Clearly, it competes with us for the same international financial resources and businesses, thus the direct attacks upon Panama. I include an interesting video link to Dan Mitchell´s Tax Haven Speech on Capitol Hill; Dan is a reputable tax expert, member of the CATO Institute, and publishes regularly on the WSJ and NYT. My Blog provides extensive historical and relevant information regarding these issues. I invite you to navigate through it and welcome your comments and contributions.

by Dan Mitchell

There hasn’t been much good economic news in recent years, but one bright spot for the economy is that the United States is a haven for foreign investors and this has helped attract more than $10 trillion to American capital markets according to Commerce Department data.

These funds are hugely important for the health of the U.S. financial sector and are a critical source of funds for new job creation and other forms of investment.

https://danieljmitchell.wordpress.com/2011/04/24/senator-rubio-representative-posey-and-other-lawmakers-fighting-to-stop-irs-proposal-that-would-drive-investment-from-u-s-economy/

|

Recent Posts

-

(English) Trump’s Lesson

-

(English) U.S. Emerging as ‘Leading’ Tax, Secrecy Haven, EU Report Says

-

(English) Prosperous Panama

-

(English) Russian Intervention in American Election Was No One-Off

-

(English) Usual Suspects? Co-conspirators in the business of tax dodging

-

(English) E.U. Includes U.S. on List of Potential Tax Havens

-

Discurso de investidura del nuevo presidente de Estados Unidos, Donald Trump

-

Comunicado al país del Consejo Nacional de la Empresa Privada (CONEP)

-

(English) EL RETORNO DEL PENDULO III

-

(English) Panama Adapts as an International Financial Center

-

(English) Wedlake Bell On Eu’s Proposed Trust Disclosure Rules

-

(English) OCDE es la mayor amenaza mundial al Estado de Derecho

-

Califican de ‘doble moral’ actuación de países de la OCDE

-

(English) Panama Canal NYT Article Disappointingly Omits the Real Story

-

OMC reitera fallo a favor de Panamá

-

(English) Panama Papers, Tax Planning, and Political Corruption

-

(English) For research, we pretended to be crooks and terrorists and tried to buy shell companies. The results were disturbing.

-

GAO (Oficina de Rendición de Cuentas del Gobierno de los Estados Unidos)

-

Proyecto Senador Levin: Conozca A Su Cliente

-

(English) Special Meeting of the Permanent Council, March 30th, 2016

-

(English) Switzerland Must Stand Up For Its Financial Centre, Says Geneva Professor

-

(English) Common Reporting Standard must include all major financial centres to be effective, warns the IFC Forum

-

(English) Forget Panama, try Belgium for a cozy tax deal

-

El nuevo paraíso fiscal es EU

-

¿Paraíso Fiscal o Plataforma de Servicios y Negocios Internacionales?

-

Colombia, la OCDE y el exabrupto galo

-

(English) Letter from James Bacchus to Jose Angel Gurria

-

OMC falla a favor de Panamá en pugna comercial con Colombia

-

(English) Pfizer Chief Defends Merger With Allergan as Good for U.S

-

(English) US overtakes Caymans and Singapore as haven for assets of super-rich

|